Do You Depreciate Furniture . select the type of furniture, purchase price, and the number of years owned to determine the current value due to. furniture, appliances, and tools. If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than $500, those expenses fall into class. are you in the process of calculating furniture depreciation? you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. Knowing how to accurately determine the value of your furniture assets. 27, 2017, allow businesses to write off the entire amount of the furniture for the year. furniture loses half its value in just two years. Knowing what affects depreciation, like how much you use it and. the new rules, which apply to business furniture purchased and put into service after sept.

from youngandtheinvested.com

Knowing how to accurately determine the value of your furniture assets. 27, 2017, allow businesses to write off the entire amount of the furniture for the year. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. Knowing what affects depreciation, like how much you use it and. furniture, appliances, and tools. are you in the process of calculating furniture depreciation? the new rules, which apply to business furniture purchased and put into service after sept. you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than $500, those expenses fall into class. furniture loses half its value in just two years.

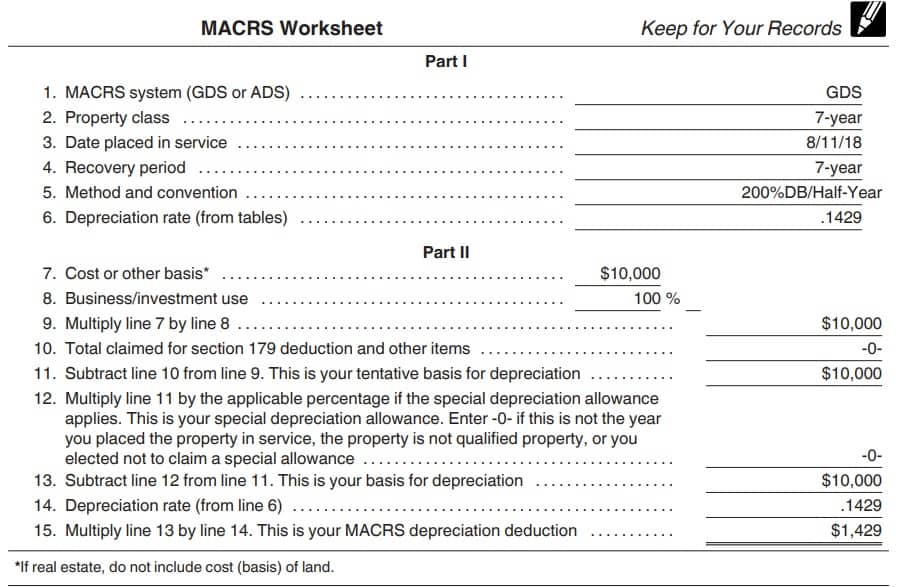

MACRS Depreciation, Tables, & Method (All You Need to Know!)

Do You Depreciate Furniture Knowing how to accurately determine the value of your furniture assets. If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than $500, those expenses fall into class. Knowing what affects depreciation, like how much you use it and. Knowing how to accurately determine the value of your furniture assets. are you in the process of calculating furniture depreciation? select the type of furniture, purchase price, and the number of years owned to determine the current value due to. you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. 27, 2017, allow businesses to write off the entire amount of the furniture for the year. furniture loses half its value in just two years. furniture, appliances, and tools. the new rules, which apply to business furniture purchased and put into service after sept.

From exovrawwf.blob.core.windows.net

Depreciation Rate Furniture Rental Property at Charles Franklin blog Do You Depreciate Furniture 27, 2017, allow businesses to write off the entire amount of the furniture for the year. furniture, appliances, and tools. Knowing what affects depreciation, like how much you use it and. are you in the process of calculating furniture depreciation? furniture loses half its value in just two years. If you buy a new desk, a refrigerator. Do You Depreciate Furniture.

From furniturewalls.blogspot.com

How Much Does Furniture Depreciate Per Year Furniture Walls Do You Depreciate Furniture Knowing how to accurately determine the value of your furniture assets. the new rules, which apply to business furniture purchased and put into service after sept. 27, 2017, allow businesses to write off the entire amount of the furniture for the year. If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than. Do You Depreciate Furniture.

From dxobuwzlr.blob.core.windows.net

How Do You Depreciate Equipment at Buford Morrell blog Do You Depreciate Furniture are you in the process of calculating furniture depreciation? If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than $500, those expenses fall into class. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. 27, 2017, allow businesses to write. Do You Depreciate Furniture.

From dxoqalekx.blob.core.windows.net

Depreciation Value For Furniture at Kelly Rodrigues blog Do You Depreciate Furniture the new rules, which apply to business furniture purchased and put into service after sept. you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. are you in the process of calculating furniture depreciation? Knowing how to accurately determine the value of your furniture assets. Knowing. Do You Depreciate Furniture.

From dxoywiold.blob.core.windows.net

How Much Does Furniture Depreciate In A Year at Garrett Hardin blog Do You Depreciate Furniture select the type of furniture, purchase price, and the number of years owned to determine the current value due to. are you in the process of calculating furniture depreciation? Knowing what affects depreciation, like how much you use it and. furniture, appliances, and tools. Knowing how to accurately determine the value of your furniture assets. 27, 2017,. Do You Depreciate Furniture.

From ceujwrtw.blob.core.windows.net

How Many Years To Depreciate Furniture at Yvonne Farfan blog Do You Depreciate Furniture 27, 2017, allow businesses to write off the entire amount of the furniture for the year. Knowing how to accurately determine the value of your furniture assets. the new rules, which apply to business furniture purchased and put into service after sept. you might acquire a depreciable property, such as a building, furniture or equipment, to use in. Do You Depreciate Furniture.

From tipmeacoffee.com

Depreciation Definition and Types, With Calculation Examples Do You Depreciate Furniture you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. 27, 2017, allow businesses to write off the entire amount of the furniture for the year. Knowing how to accurately determine the value of your furniture assets. Knowing what affects depreciation, like how much you use it and.. Do You Depreciate Furniture.

From www.wikihow.com

4 Ways to Calculate Depreciation on Fixed Assets wikiHow Do You Depreciate Furniture furniture, appliances, and tools. are you in the process of calculating furniture depreciation? the new rules, which apply to business furniture purchased and put into service after sept. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. furniture loses half its value in just. Do You Depreciate Furniture.

From dxoxwrkei.blob.core.windows.net

Depreciation On Furniture And Equipment at Benton Small blog Do You Depreciate Furniture If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than $500, those expenses fall into class. the new rules, which apply to business furniture purchased and put into service after sept. you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional. Do You Depreciate Furniture.

From dxobuwzlr.blob.core.windows.net

How Do You Depreciate Equipment at Buford Morrell blog Do You Depreciate Furniture Knowing how to accurately determine the value of your furniture assets. furniture loses half its value in just two years. the new rules, which apply to business furniture purchased and put into service after sept. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. If you. Do You Depreciate Furniture.

From youngandtheinvested.com

MACRS Depreciation, Tables, & Method (All You Need to Know!) Do You Depreciate Furniture the new rules, which apply to business furniture purchased and put into service after sept. 27, 2017, allow businesses to write off the entire amount of the furniture for the year. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. are you in the process of. Do You Depreciate Furniture.

From dxoagbaop.blob.core.windows.net

Provide Depreciation On Furniture Journal Entry at Brenda Jimenez blog Do You Depreciate Furniture are you in the process of calculating furniture depreciation? Knowing how to accurately determine the value of your furniture assets. If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than $500, those expenses fall into class. you might acquire a depreciable property, such as a building, furniture or equipment, to use. Do You Depreciate Furniture.

From dxoodkvon.blob.core.windows.net

How Do You Depreciate Furniture at Duane Mahar blog Do You Depreciate Furniture select the type of furniture, purchase price, and the number of years owned to determine the current value due to. you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. furniture, appliances, and tools. furniture loses half its value in just two years. Knowing how. Do You Depreciate Furniture.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow Do You Depreciate Furniture If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than $500, those expenses fall into class. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. you might acquire a depreciable property, such as a building, furniture or equipment, to use. Do You Depreciate Furniture.

From dxoodkvon.blob.core.windows.net

How Do You Depreciate Furniture at Duane Mahar blog Do You Depreciate Furniture furniture loses half its value in just two years. the new rules, which apply to business furniture purchased and put into service after sept. you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. are you in the process of calculating furniture depreciation? Knowing what. Do You Depreciate Furniture.

From exooapsto.blob.core.windows.net

How Much Does Furniture Depreciate at Martin blog Do You Depreciate Furniture Knowing how to accurately determine the value of your furniture assets. 27, 2017, allow businesses to write off the entire amount of the furniture for the year. If you buy a new desk, a refrigerator for your restaurant, or a tool worth more than $500, those expenses fall into class. the new rules, which apply to business furniture purchased. Do You Depreciate Furniture.

From www.smartcapitalmind.com

How do I Calculate Furniture Depreciation? (with picture) Do You Depreciate Furniture you might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. furniture loses half its value in just two years. furniture, appliances, and tools. Knowing what affects depreciation, like how much you use it and. are you in the process of calculating furniture depreciation? select. Do You Depreciate Furniture.

From ceujwrtw.blob.core.windows.net

How Many Years To Depreciate Furniture at Yvonne Farfan blog Do You Depreciate Furniture Knowing how to accurately determine the value of your furniture assets. 27, 2017, allow businesses to write off the entire amount of the furniture for the year. furniture loses half its value in just two years. the new rules, which apply to business furniture purchased and put into service after sept. are you in the process of. Do You Depreciate Furniture.